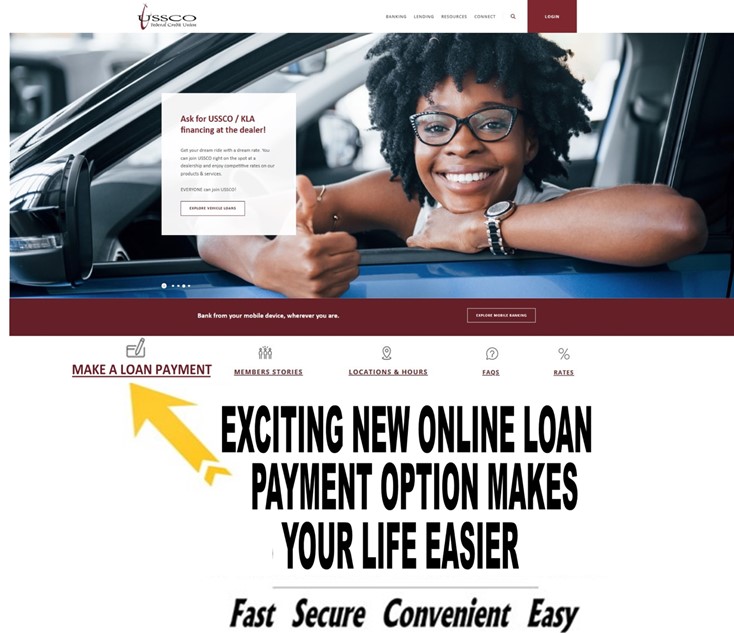

Set Up Your Account and Make a Loan Payment:

Step-by-Step Instructions

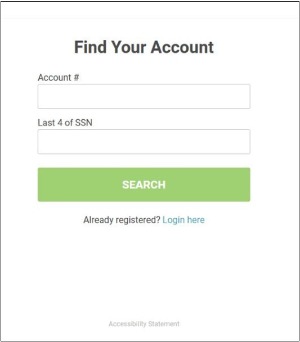

Set Up Your Account

- Member account number

For security purposes, you need to call us at 866.877.2628 toll-free to get your full member number to set up your account - Last four of your SSN

- First name

- Last name

- Email [this will be your login]

- Mobile number

- Choose a simple 4-digit PIN

- Set up frequency of payment reminders

- Choose “email” or “Text me” to set up how you want to receive your reminders

- Click on “Continue”

Set Up Your Loan Payment

- Select payment method: Debit Card or Bank Account

- Enter information requested [example shown if paying with bank account]

– Bank Account Holder Name

– Routing Number

– Bank Account Number

– Confirm Account Number

– Account Type

– Save Payment Method - Click on “Continue”

- Review and confirm all the information is correct

- You will see completed transaction on screen

- You will get an email or text confirmation to account you selected at account set-up

Make A Loan Payment

- When you login again to make a payment, it will list all loans you’ve set up

- If you need to pay another loan on the account, you can also go to your name in the top left and click “switch” to select another loan to pay

- You can select automatic payments for a specific date or make a manual one-time payment for any date of your choice

- To set up a different loan payment, follow the same steps

That‘s it!

What could be easier? Or more convenient?

Select a category above and then click on a topic to learn more.

Report a lost or stolen USSCO debit card

Revised 06-15-2022

What is Mobile Deposit?

Mobile Deposit allows you to deposit checks using the camera on your mobile phone or tablet.

How do I make a mobile deposit?

To make a mobile deposit, follow these steps:

- Log into your Mobile Banking app on your mobile device

- Click on DEPOSIT

- Using your mobile device, click CHECK FRONT and take a picture of the front of your check with your mobile device

- Click CHECK BACK and take a picture of the back of your endorsed check with your smart phone

- Fill in the CHECK AMOUNT

- Click on MAKE DEPOSIT

- You will receive a message on your mobile device that the deposit was successful

- You will receive an email confirmation of your deposit

- Be sure to verify the deposit to your account the following business day

What happens if I don’t get confirmation that the deposit was successful?

If your deposit was not successful, you will receive an error message with prompts aimed at fixing the problem. Your check is not deposited into your account until you receive confirmation that it was successful. It is your responsibility to ensure you receive confirmation that your deposit was successful before that money can be accessed.

What do I need in order to use Mobile Deposit?

To use Mobile Deposit, you must have the following:

- An open checking, savings, or money market account in good standing at USSCO Federal Credit Union

- Be enrolled in USSCO’s online banking

- Submit a completed and approved Mobile Deposit application

- The most recent version of our Mobile Banking app for iPhone/Android/iPad downloaded from The App Store or Google Play

Who is eligible to use Mobile Deposit?

Mobile Deposit is available to members who meet the following criteria:

- Maintained a USSCO Federal Credit Union member account relationship for at least 90 days [3 months] OR provided prior 90 days [3 months] activity from another financial institution

- The account must be in good standing

- No overdrafts within the last 90 days [3 months]

- Enrolled in USSCO’s online banking

How do I request Mobile Deposit?

Members may stop in or call any community office to receive a copy of the Mobile Deposit Application Packet which includes Frequently Asked Questions [FAQs], Mobile Deposit Agreement, and Application. Read and keep a copy of the FAQs and Mobile Deposit Agreement for future reference.

Complete and return the application to any community office for review/approval.

Do I need to use a deposit slip to make a deposit through Mobile Deposit?

No deposit slip is required. You only need to endorse the back of your check, then take a picture of the front and back of the check being deposited.

Should I endorse my check before taking a picture of it?

Yes, you should endorse your check as follows before taking a picture:

“For Mobile Deposit Only” [Write all four words on first endorsement line]

Account Number

Checks that are not properly endorsed will be rejected when you attempt to make the deposit.

What types of checks can I deposit with Mobile Deposit?

Checks made payable to you and drawn on a bank within the United States are eligible for deposit. Some large business-size checks may not work with Mobile Deposit.

The following types of checks cannot be deposited using USSCO’s Mobile Deposit:

- Checks drawn on a financial institution located outside the United States

- Checks not payable in United States currency

- Savings Bonds

- Third Party Checks

- Returned or Re-deposited items

- Checks requiring two endorsements

Please refer to the Mobile Deposit User Agreement for a complete list of ineligible items.

When will my funds be available from deposits made in Mobile Deposit?

Deposits will be available in real time as processing permits.

Are there limits for deposits made through Mobile Deposit?

Yes. You can deposit checks into both your share and checking accounts if you choose, but the deposit limits are combined and limited as follows:

- Combined: $3,000.00 per day / $12,000.00 per month

- Combined: 5 checks per day / 25 checks per month

What do I do with a check after I deposit it through USSCO’s Mobile Deposit? Write “MOBILE DEPOSIT ON [insert date]” on the face of the check. Verify that the deposit shows on your monthly statement. Keep the deposited checks in a secure area for 30 days and then destroy.

You may be asked to produce the original check if a problem occurs during the mobile deposit process, so it is important to retain deposited checks for 30 days before they are destroyed.

Is my personal or financial information stored on my phone?

No. USSCO’s Mobile Banking does not save any files with personal or financial information on your mobile device. Checks deposited using Mobile Banking are not saved to your pictures. That information stays strictly within online banking.

What is the cost for Mobile Deposit?

There is no charge to members for using USSCO’s Mobile Deposit. Web access is needed to use the Mobile Banking app. Your mobile carrier may charge access fees depending on your individual plan. Check with your carrier for specific fees and charges. Message and data rates may apply.

I have a Business Account. Can I use Mobile Deposit?

Business members, please contact your local community office to request information about our uCapture remote deposit product —which is geared to handle your check deposit volume.

iPhone and iPad are trademarks of Apple, Inc.